Another week of demo means another round of surprises—it’s like Christmas in March! This week we uncovered fun things like broken plumbing, termite-damaged joists and roof leaks. It feels like we’re taking leaps backwards, with the house becoming more dismantled by the day…

At this point it would probably have made more sense to bulldoze the place and build a new house from scratch, but that wasn’t in our budget, so we’ll stick with the plan and keep forging ahead.

A few angles for reference, as it’s easy to become disoriented in a sea of dirt and 2x4s…

Here’s the Before, looking at the old living room and front door:

And today. They spent days trying to remove that tile and layers of laminate and screws below, only to end up ripping out the entire subfloor:

Here’s the original view walking into the house from the front door:

And the After. We’re going for that “rustic look”…

The good news is that most of the plumbing is done (we had to re-route the master bathroom shower lines, add washer/dryer hookups and change the sink location in the kitchen). The electrician has also installed a brand new panel, and today we’re meeting with the HVAC crew so they can begin installing the new system. All of our ducks are in a row, so we just need to avoid any big surprises to stay on track (what a miracle that would be!)

In this week’s vlog you can see more progress on the house, and we also addressed a topic that many of you have been asking about—”How do you know if it’s a good deal?!”

In this episode, Lucas walks you through the steps we take to analyze a deal to see if it’s a good investment or not. We go through this process for every potential purchase, including the two here in Florida (update on the 5-unit Bungalow—still under contract and we’re hopeful that it’ll finally be ours by the end of this month!)

If you can’t watch the video now, I highly suggest you save it to come back to later (for Susie’s adorable cameos, if nothing else!) but I’m also including a written summary here.

1. How do you find deals?

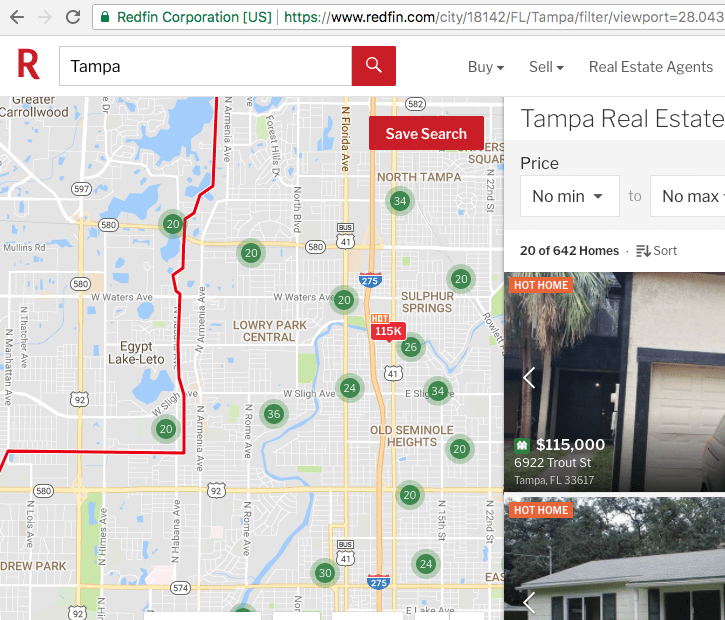

These each deserve a blog post of their own, but the basic ways are through direct mail marketing (you can buy lists online and target specific niches), driving around to identify distressed houses and reaching out to the owner directly, advertising with road signs, joining local investor groups and partnering with people, working with wholesalers, and of course the most common way—working with a realtor/broker or looking on MLS sites like Zillow and Redfin.

We found the Heights House on Redfin, and our 5-unit bungalow on LoopNet which is similar to the MLS, but for commercial properties. Nowadays, deals are scarce and competition is at an all-time high, but they’re still out there if you look hard enough.

2. What do you look for?

This all depends on your specific strategy, but location should always be a major factor as it will have a huge impact on your results. Make sure you drive through the neighborhood first to get a good feel of the demographic, and the pros & cons of investing there.

Value-add opportunities are crucial. We focus on buying properties that need work, so that we can unlock its potential and therefore increase the value. Properties that have already been remodeled are going to go for top dollar, making it difficult to cash flow or sell for a profit, especially in today’s market.

Key words in the listing are great indicators of a property’s condition—we look for terms like “Needs TLC” or “investor special”—there’s also less competition since your average home buyer wants something move-in ready.

And of course, you’ll need to take the price into consideration. Compare the price per square foot to similar homes in the area, and make sure you aren’t overpaying. Don’t eliminate a property you like simply because they are asking too much—it doesn’t hurt to put an offer in and you never know where it will lead!

3. Decide on your strategy

Most investors either buy & hold to keep as a long term rental, or flip it. We’re focusing on building wealth by buying & holding to keep as rentals, and also plan to utilize short term income (AirBnB) in the near future (more on that in a future post). Eventually we’ll look into flipping too, but that requires a very different evaluation. For this post, we’re focusing on a long term (annual lease) rental strategy.

The two most important words when evaluating a buy & hold deal? Cash Flow. This is your profit each month after all of your expenses have been paid (Rental income – Expenses = Cash Flow). Here in Florida especially, you can’t count on appreciation (remember what happened in 2007?), so the tried & true method to build long term wealth through investing is slowly over time. This is a marathon, not a sprint!

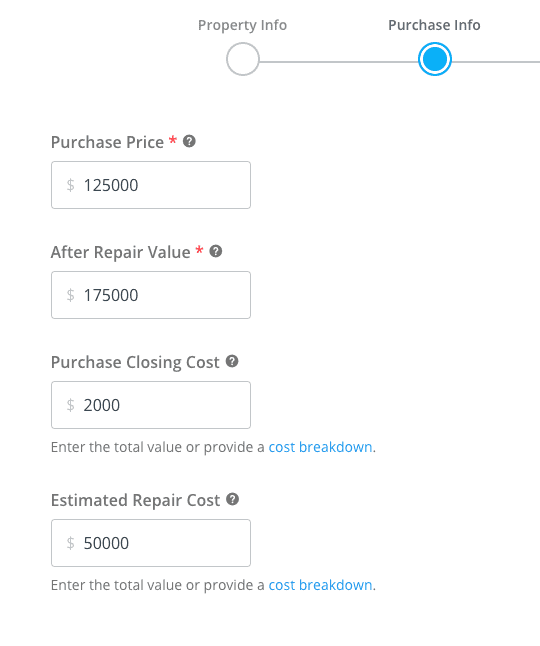

Let’s take a look at a real-life active listing here in Tampa to evaluate.

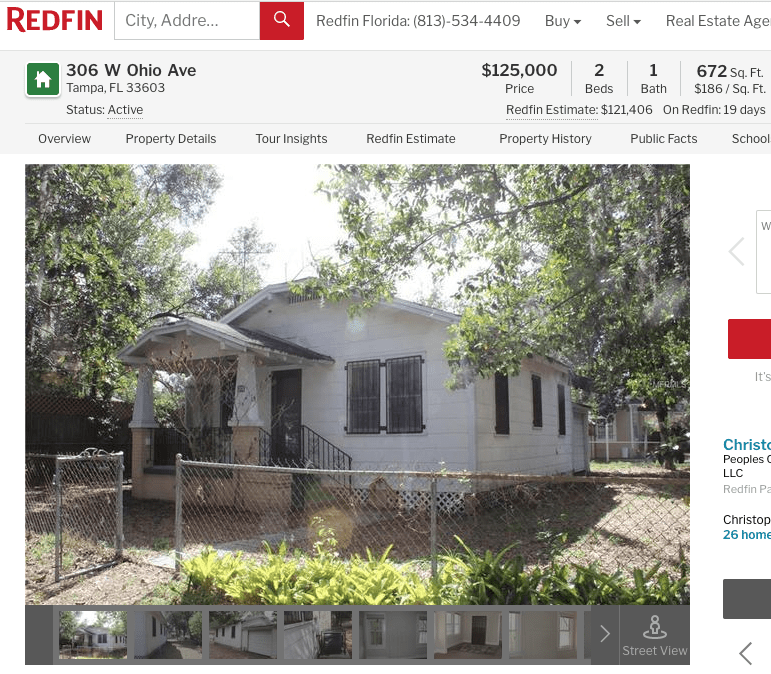

This one popped up on the market not too long ago, and at a glance, it meets our basic criteria: decent location (it’s in an “up and coming” neighborhood), value add opportunities (Craftsman charm and that garage could be turned into a third bedroom) and price ($125k is affordable!). Now that we’ve determined it’s something we want to take a closer look at, let’s do a thorough evaluation.

4. Crunch the numbers

We use the Property Evaluation calculators over at biggerpockets.com. This website & podcast has taught us a lot of what we know, and I think it’s the single best resource out there for investors. We did pay for a Pro membership, but you can do a few evaluations for free using their calculators without the membership.

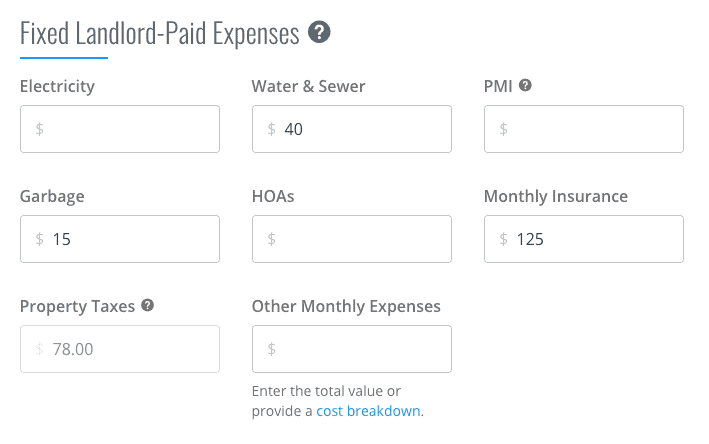

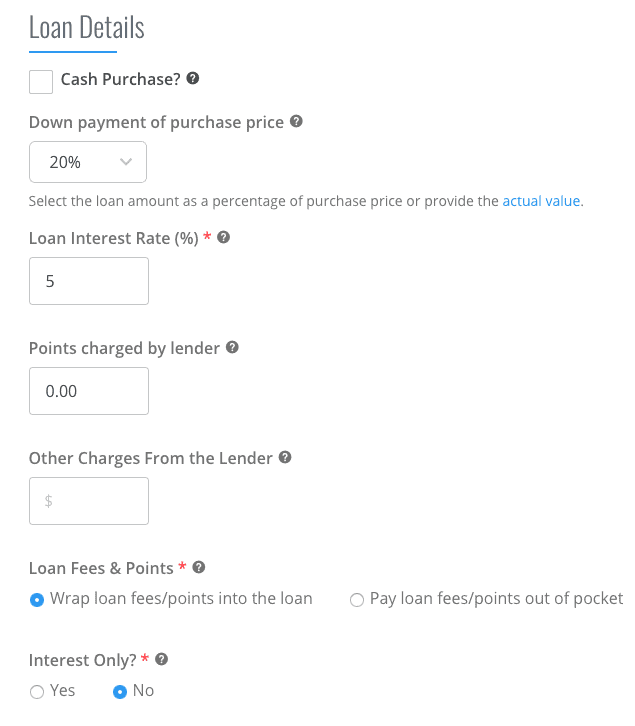

First, let’s input our expenses. This is where a lot of investors go wrong. You just have to pay the mortgage, taxes and insurance, a property manager and maybe a few utilities, right? Wrong! Don’t forget maintenance, CapEx, and Vacancy, not to mention potential HOA’s, PMI or Flood Insurance if you live in a coastal area. Let’s break these down as they appear on our calculator:

Electricity: Most tenants pay their own, so we leave that blank (unless it’s for a short term/AirBnB rental)

Water, Sewer & Trash: That’s usually on the landlord. Around here it averages $55-$60/unit total.

PMI: Private Mortgage Insurance is required by your lender if you put down less than 20%.

HOA: If you have a home or especially a condo in an HOA, those expenses can eat up your profit—don’t forget to include them!

Monthly Insurance: This number will vary by the provider you choose, but you can look on the Redfin property calculator which will give you an estimate.

Property Taxes: Redfin or your local county assessor’s website provides this data, but make sure to round up for next year because they almost always increase annually!

Other Monthly Expenses: These can be special things like landscaping, pool maintenance or other utilities you will pay for each month.

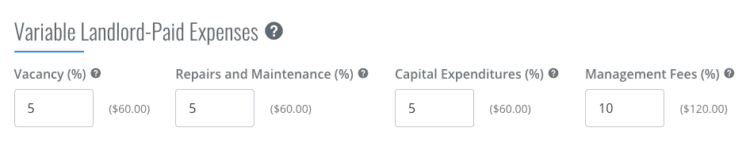

Next comes the important variable monthly expenses that people often forget to include!

Vacancy: The property is most likely not going to be rented 365 days/year—don’t forget about tenant turnover (or worse—the dreaded eviction!) ! 3-10% is a typical range and we budget 5% on average, but this will depend on your location and specific market.

Repairs & Maintenance: These are smaller routine expenses like clogged drains, a broken window, etc. that regularly pop up. Make sure you set aside between 5-15% of the monthly rent to cover these costs for when they inevitably arise.

Cap Ex: Your big ticket items like a new roof, HVAC, driveway, etc. These are less frequent but very costly, and can wipe out your entire profit over a decade with one bill if you don’t set aside a reserve each month. As an average we use 5%, but you can decrease that number if it’s a brand new or remodeled home, and increase it if it’s an older home that will likely need larger repairs soon.

Management Fees: This is commonly 8-10% of your monthly rent, and it’s important to make sure the property still cash flows with it even if you plan to self manage. Just because you can be a landlord now, doesn’t mean you won’t end up moving/getting sick/tired of doing it in the future. In fact, that most likely WILL be the case one day, so plan for it now. For this evaluation, we decided to omit this number because we do plan to be full time landlords for our properties—but we wouldn’t buy it unless the numbers worked both ways!

After you have your landlord expenses figured out, you need to determine the biggest portion of your monthly expenses: the mortgage.

For demonstration purposes, I’m using standard bank loan terms of 20% down, 5% interest and a 30 year amortization. Note that if we were actually evaluating this property for ourselves, we’d either have to pay cash or use private investors since we don’t qualify for traditional bank loans (you can learn more about why here).

Another thing to note—it’s quite difficult to get a good deal these days (unless you get lucky) without paying all cash. That was the only way we were able to get the Heights House, and it was a 48 hour bidding war that went way over asking, due to fierce competition. And it’s not just Florida—the market is tough everywhere right now.

Next, we have to think about our rehab budget. This won’t affect your monthly cash flow, but it will impact your overall return and your purchasing power, if you plan to continue investing.

People often ask “How do you calculate your renovation budget?” and my answer is: practice and experience. It takes a long time to feel confident in your numbers, but even then it’s just an estimate because you can’t predict everything. Although I’ve renovated four homes, the Heights House is the first one in a new market so I’m still learning the ropes. At just a few weeks into demo, we’re already quite a bit over our original budget prediction, but with each house we’ll become a little better at hitting that mark.

Of course, if you can get estimates from contractors before you buy, that will help immensely. A lot of experienced investors warn that you should double whatever you think your budget is to be safe, and I can agree with that, especially if you’re a beginner.

For investment properties that you plan to use as long term rentals, you don’t want to overspend. Keep the finishes in line with what renters expect for the neighborhood, and choose durable and long-lasting materials to reduce the inevitable wear & tear. For this evaluation, we’re using a rehab estimate of $50k, which should cover a basic repair including a garage conversion, exterior/landscaping, and account for a few surprises along the way.

Don’t forget that unless you get a construction loan (or private loan), you’ll need to have cash reserves built up to pay for your renovation.

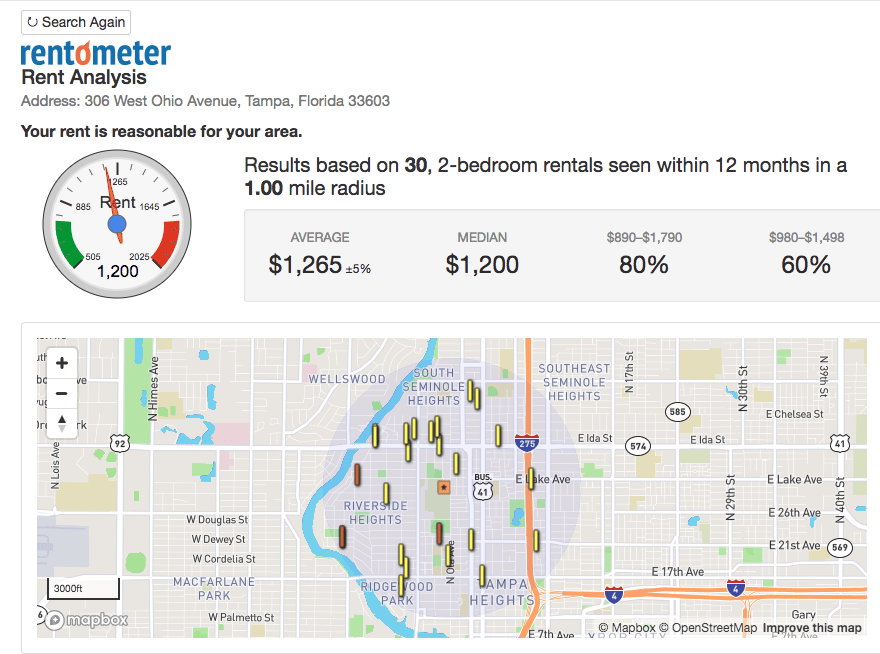

And that is it for our costs and expenses! Now you need to figure out how much you can expect the place to rent for. An easy way to figure this out is to use sites like Zillow, Craigslist, local Facebook groups and Rentometer.com to compare similar properties in your area.

Make sure to factor in things like washer/dryer hookups, parking situation, if it’s a condo/apartment/single family home, proximity to freeways/airports, school districts, etc. Things that seem small can have a big impact on both price and vacancy rate. Be as thorough as possible, and err on the side of caution.

For this property, it seems like $1200 is a reasonable asking price (especially if you added that third bedroom!)

Landlords can also find ways to earn additional income, like charging application fees, a pet deposit or having coin-operated laundry installed in a common area (for multi-unit buildings).

5. So… should you buy it?

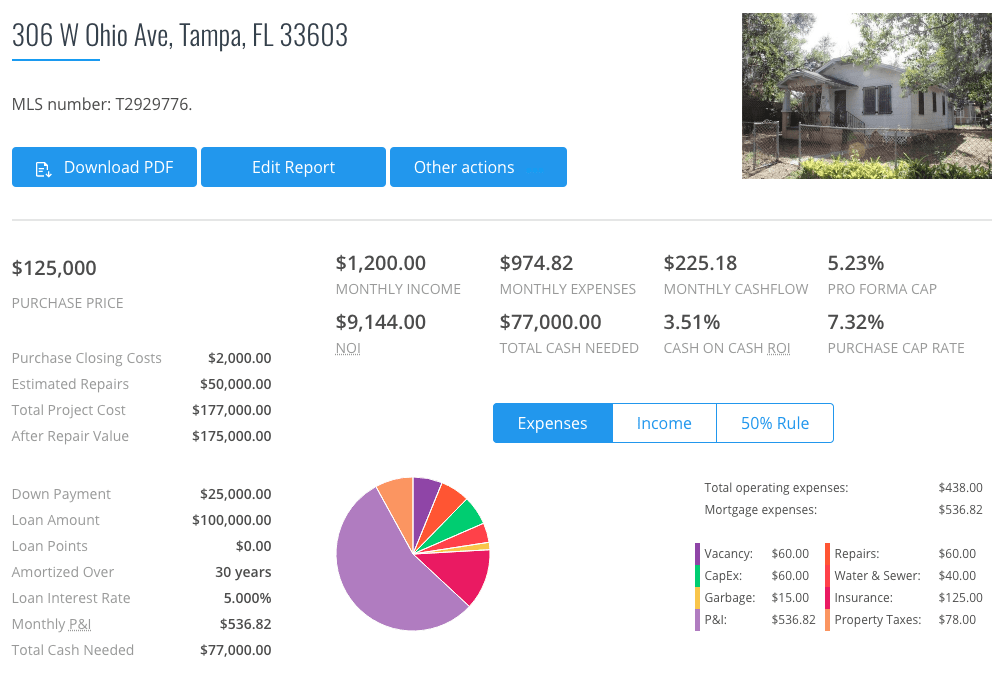

Now that we have both our rental income AND expenses, we can figure out the most important number: Cash flow!

According to our calculator… we’re cash flowing $225 per month!

Personally, we aim for at least $200/mo per unit, but this will vary by investor depending on the market, volume, amount of work, risk tolerance, etc. A big factor for us is also the total cash needed and ROI, since we need to recycle our funds to use for future deals.

Now you might be thinking, “Hold on a sec—I’m taking on $125k of debt PLUS spending over $50k in cash, plus months of rehab work AND I have to become a landlord, all to potentially make just $225 a month?”

Yep. Welcome to the world of Real Estate investing. This is NOT a get-rich-quick solution. It’s going to take us years, decades actually, to build up a portfolio large enough to reach our financial goals. We’d be making a whole lot more money right now if we’d have just stuck with our day jobs… but it’s not about the money—it’s about the lifestyle. We love what we do and we have our freedom. Of course we still work our butts off every day, night and weekend, but a lot of it doesn’t feel like work at all. And we’re working towards a shared goal that we can only reach on this path of self-employment.

Sorry, got a little off-topic there. I could get into this for hours and hours—it’s truly my passion! Anyway, the moral of this post is to share how we have learned (through months and years of studying and practice) to evaluate potential deals, and I hope I’ve been able to explain it in a way that you can easily digest and reference if you are on your own investing path. If you have any more questions or need clarifications, I’d love to answer (we really just scratched the surface here!) and of course, we plan to do more vlogs on specific topics in the future. Just let me know what you want to hear about!

Also, we thought it’d be fun to do an ‘Ask Us Anything’ Q&A video so you can get to know more about the faces behind the vlog/camera—so leave your anonymous non-real estate related question here—don’t be shy, nothing is off limits! 😉

Thanks for taking the time to read if you’ve made it this far! More updates on the way…

Robert says

Good luck with the heights house! What you show is amazing. I hope it will be stunning home. 🙂

Denise says

Jenna- need to paint the exterior of my house previously you stated you use Valspar paint correct? I think that is your go to brand and used it on the Cottage House flip. Did you go with flat or a sheen?

Admire your patience and perseverance with remodeling…geez this is more than what you expected but no doubt it’s going to be a knock out! Can’t wait to see the afters.

Vanessa says

It helps that you are a natural born decision maker and an exceptionally hard worker. I also appreciate this post b/c I never do it this way, I just go with my gut and tough it out. I have a very careful personality but for some reason I do a 10-second drive-by analysis and go from there. It’s all I used to be able to do when buying off the courthouse steps the way I did it years ago. The inspection is key for me. The rest I just wing. I’m glad that you are more careful than I am though!

Cindy says

Jenna,

Wow…. I sure hope you both know what you are doing. It seems so complicated for me. One thing I know for sure, the house will be gorgeous when its done!!! With any house, you never know what you are getting. Cant wait to see what you guys will do.

Lots of luck!

Cindy, fyi, I am still so confused about what to do for my kitchen. Im taking it slowly.

jennasuedesign says

It seems overwhelming at first (it sure was for us) but you become much more comfortable the more you do it. After analyzing so many deals, it’s just second nature to us!

stephanie says

This was my favorite episode so far- super helpful and really well organized. 🙂

jennasuedesign says

Thanks Stephanie, we’re glad you found it helpful!

Astin Hancock says

Good luck with the heights house! Hope y’all don’t get anymore surprises! Oh and Susie is the cutest!! ?

jennasuedesign says

Thank you Astin! We’re obsessed with that cat 😀

Rue Ann Eyler says

You both are amazing to take time and share all this wonderful informon , while involved in your demo and business! Oh, and Susie’s cameos are the best.

jennasuedesign says

Thank you so much for the kind words, Rue!