When I posted on Instagram about our latest AirBnb purchase and asked if anyone was interested in learning more, the questions came pouring in. I’m all for sharing what I’ve learned, so today I’m doing a deep dive and answering all of your burning questions!

Why did you sell the Riverside Retreat?

Two reasons:

- Our capital is better utilized in a newer, larger home in a more desirable location. The new house is in our target neighborhood, and we believe it will see greater appreciation long term. And, we were able to transfer our equity tax free with a 1031 exchange.

- We were tired of the headaches that come with an older home. Between multiple AC repairs, inadequate insulation and subfloor drama, it felt like there was always something that needed to be fixed. We’ve paid our dues over the years and at this stage in our journey, the extra stress just isn’t worth it.

Fun fact: we aren’t anticipating the new Airbnb to be as profitable as the Riverside Retreat, but the long term benefits outweigh any short term cashflow.

How much cash do you need on hand to start?

Assuming this doesn’t include the purchase of the house—it will vary greatly depending on the size and condition of the home, and if any renovations need to be made.

Using our most recent Airbnb as an example: it’s a 4 bed + 4 bath with 2,400 sf. We kept the renovation very minimal, updating just the backyard with string lights, a TV setup, grill and hot tub.

The total cost to fully furnish and stock the home including kitchen and bath supplies (plus extra sets for backups) was $25,912. This was shopping frugally, including secondhand locally and waiting for sales. For a home this size, I’d say this is about the minimum you can expect to spend if you want decent furnishings (you don’t want to go too cheap!)

The hot tub and backyard updates came in at $21,100, for a grand startup total cost of $47,012.

How do you fund the purchases?

When we first started out, we negotiated a lease-to-own contract and renovated the home while we were living in it, and while our primary home was being built. I had some capital from selling two previous homes in California, and used that to invest in a much more affordable Florida market.

After our home was built and the Riverside Retreat renovated, we were able to refinance both and use that equity to help fund the purchase and renovation of two more homes. This is a well-known strategy investors use called the BRRRR method (buy, rehab, rent, refinance, repeat).

Our city has seen massive appreciation over the past several years, which has made a big difference. One of the reasons we chose to move to Tampa was because of the favorable real estate investing market, so it’s no accident we’re here.

Our plan is to continue renovating, refinancing, and using the equity to purchase the next property. There’s really no limit to how many times you can do it! Tip: You can learn more about all the different ways to finance properties in this post.

What to look for when searching for a property?

First, you’ll need to do some research to understand what makes a successful rental in your specific market. Confirm that short-term rentals are legal in your area and that the property is not governed by an HOA. I recommend using AirDNA to evaluate the competition, occupancy rates, and analyze the market data.

In our area, there’s a demand for (and lack of) properties that sleep at least 12 guests with a pool or spa, so we’re focusing on that niche. Our search criteria is at least 4 bedrooms, 3 bathrooms, space for a pool/spa, and a newer build.

For you, it may be proximity to an attraction, room layout, architectural style or specific neighborhood. Figure out what renters are looking for in your area and serve their needs.

How do you choose the location?

We’ve been focusing on a few different neighborhoods that meet our criteria: convenience to city attractions, potential for long term appreciation, and price point. We also try to keep our longer renovation properties within short driving distance from our home, since we’ll be working there every day.

In some vacation destinations there are obvious attractions where location is the most important factor (ie ski/lake towns, theme parks, etc) but our city is pretty spread out, and there’s a lot to offer in many neighborhoods.

How long does it take to get an Airbnb up and running?

We spent 2-3 months setting up our most recent Airbnb, as well as our Poolside Palms property. This was furnishing the entire home from scratch, and minimal renovations.

It’s definitely possible to get it done quicker, but it was only the two of us working on it, and I wasn’t able to dedicate full time hours.

I’m not including the Hacienda Hideaway or Riverside Retreat because those were slow, 2+ year renovations and not typical for an Airbnb investment!

Do you manage it yourself or hire out?

We have never, and would never self manage. Property management requires a specific skillset and lot of time that we don’t have, nor do we want to focus our efforts on at this stage in our lives.

For some of you just starting out, it may not be a bad idea to start off self managing. There’s definitely a learning curve, but you’ll have full control over the guest experience, and will gain valuable insight about the business. Plus, you won’t have to pay a hefty 20-25% management fee.

For us, running the day-to-day operations was never part of our plan, so we factored in the added expense and it has been worth every penny.

Despite this, we are still quite involved in the ongoing maintenance and decision making process. We talk to our property manager at least once a week, and visit the properties often for repairs or replacements. We could be more hands off if we wanted and hire everything out, but we’d rather do certain tasks ourselves to make sure they’re done right.

What are the real profits of an Airbnb?

Just like any other business, the profit will vary greatly based on many factors. I think a lot of beginners are over-optimistic about the earning potential, and aren’t prepared for the downsides or the work that goes into it. There’s more competition now than ever, and gone are the days where you can list any property and expect to be profitable.

You also have to be prepared for big wins and losses. Seasonality plays a factor, and large expenses can pop up out of nowhere and wipe out months of earnings. We’ve had huge months and big negative months—it’s all just part of this business.

To date, our highest monthly net profit was $16,579 (with 3 properties)—this was with $43,543 in top line revenue.

Our worst month was a loss of -$9,025. This happened last year due to a hefty property tax bill and outdoor furniture replacement (every November is negative due to tax bills—we don’t escrow those).

These numbers are after all expenses, including a 20% property management fee, taxes, insurance, maintenance and repairs, replacement costs, etc. So far this year we’re averaging around $8,300 in monthly net profit, but this should decrease as we get into the slower seasons.

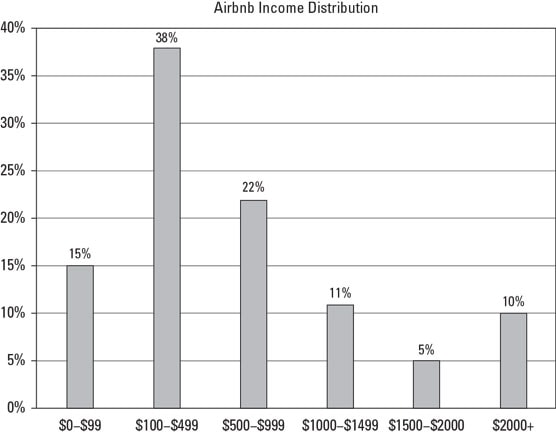

I will caveat this by saying this is not the norm for most Airbnb owners. One study claims that the average monthly earnings for hosts in the US is only $924. Here’s a more realistic picture:

Of course, this takes into account the hosts that might only rent out a bedroom in their home, or only rent their property out part time. One thing I love about this business is the freedom and flexibility to make it anything you want!

What are the monthly expenses?

Here’s a list of our typical monthly expenses:

- Property management (20% of revenue)

- Cleaning fees

- Maintenance + repairs

- Replacements

- Mortgage

- Taxes

- Insurance

- Electric

- Water/sewer/trash

- Internet/TV

- Lawn care

- Pest control

- Pool service

Our monthly expenses typically range anywhere from $5-$10k per property, with the mortgage and property management fees taking up the majority.

What has been your most unexpected cost?

Replacing furniture, and ongoing maintenance expenses. Our Florida summers are brutal and the backyard furniture hasn’t lasted more than a year. We’ve had to replace almost all of the outdoor furniture at Poolside Palms and Riverside Retreat—some more than once.

Those two properties are nearly 50 and 80 years old, and keeping up with the maintenance has also been a constant battle. We’ve replaced two AC units, washer and dryer, water heater, kitchen appliances, countless service calls… the list goes on.

Fortunately (surprisingly?) we’ve only had a couple minor replacements at the Hacienda so far and no maintenance issues. This reinforces our decision to trade in Riverside Retreat for a newly built home!

Where to splurge vs save?

First and foremost, I’d always recommend choosing the best house in the best location you can afford. That will make a bigger difference to your bottom line than any renovation or furnishings inside the home.

Apart from the home itself, invest in a unique amenity that separates your home from the competition. In our market, this is a pool and/or spa. It’s also a great backyard setup for entertaining larger groups and families.

Comfortable beds are a must (here are links to all of my bedroom sources) and the overall aesthetic needs to stand out. I like to include interesting design features that have a WOW factor—like ceiling beams, wall arches, canopy beds, patterned tile.

Think about creating a few ‘instagrammable moments’ around the house—ideas include a focal wall, an indoor or outdoor swing, unique art installation, a fun backdrop.

You can save by finding furniture and decor on Facebook Marketplace, and with inexpensive yet impactful DIY projects (like ceiling beams, limewash walls, door makeovers, wainscoting wall, DIY frame TV).

There are also plenty of beautiful and affordable pieces I swear by, like Loloi rugs, these sheets, these roman shades and curtains, budget mirrors, lighting on Amazon, and these outdoor chairs. You can shop everything I used in our most recent Airbnb bedrooms, the Hacienda Hideaway, and the Riverside Retreat.

How to make a space elevated and chic on a budget, but still durable for renters?

This is where my 15 years experience of budget shopping and decorating come in handy 😉 I frequently check Facebook Marketplace, OfferUp and local thrift stores for the biggest savings first.

For everything else, Amazon is my go-to for the widest selection at the best prices. You simply can’t beat their fast, free shipping and free easy returns—especially when buying in volume and keeping track of orders.

I also frequently check Walmart, Wayfair, Target, Etsy, and use Google shopping to find the best deals and specific products.

As far as durability—it’s mostly trial and error. Something may hold up perfectly for years, and then all it takes is one incident to need a replacement. I will say light colored sofas or sofas without removable slipcovers are tough to keep clean. Really, anything that can’t be easily washed is a risk.

It’s a tricky balance between choosing something more expensive and potentially more durable, vs less expensive but lower quality. In my experience, anything can get damaged, so I typically opt for less expensive. My best tip is to use aged or rustic furniture/decor, so any damage will only add to the character.

I hope this Q&A has been insightful and helpful to anyone considering AirBnb as an investment. If you have any other questions or want to do a deep dive on any specific topic, let me know in the comments and I’ll keep the posts coming. I love chatting about RE investing and am always happy to share my experience to help others just starting out!

Ali says

Thank you for your generous insights and inspiration. Love everything that you do.

Olga hernandez says

Whit out of doubt you’re the best!!! Thank you for the transparency I wish you the best ever ever and forever you guys…god bless you..god bless your family and all your new projects..

Jenna Sue says

That means a lot, thank you for the kind words Olga!

Lori says

Jenna, I can’t express how much I love each and everyone of your posts. All of them are full of valuable information. I always reread them several times. Long time follower since your first flip out here in California. ❤️

Jenna Sue says

Thanks for sticking around for so long and for taking the time to comment, Lori! I’m so glad you’re here ❤️

Karin says

Jenna, you are always so generous with information and help. All your hard work is paying off!

Jenna Sue says

Thanks Karin! It certainly didn’t happen overnight but it has been so worth the time and energy.

Alix Davis says

Thanks Jenna -great wrap up. I have an Airbnb in Hobart, Tasmania. A very different market, but the same principles apply.

Jenna Sue says

Very cool! We’d love to have a rental overseas someday 🙂

Julie says

I love a solid real estate investment and thank you for being transparent with your numbers!

Jenna Sue says

I love sharing investment strategies that work!

linda long says

We are thinking of purchasing an Air B and B on the east coast of Florida. How do you find a host that will do the best job possible for you? Any companies you would recommend? Thanks for all the info. You guys do such a beautiful job on all your homes!!

Jenna Sue says

Hi Linda, glad the post was helpful! My biggest recommendation is to ask hosts in the area for personal references. I would avoid the larger companies like Vacasa — we had the worst experience with them (along with every other host I know). I don’t have any connections in that area but I’d ask around on local host groups and forums!

linda long says

Thank you so much!

Lorraine says

Thank you for this very insightful post, it’s nice to see real numbers in addition to beautiful photos

Jenna Sue says

It was my pleasure to share!